In the face of rising inflation and the ever increasing cost of living, creating a sound investment plan has become important for those who want to create a secure financial future. Whether you’re a seasoned investor or just starting out, this article will provide some suggestions and options to navigate the complex world of investments.

It’s important to note that this is not personal advice but a guide that aims to provide you with access to information, resources and strategies that may help you make informed decisions. If you require personal advise, we recommend reaching out to a financial adviser who can tailor a plan to your specific circumstances.

Review your finances and set your goals

It’s a good idea to understand your current financial situation before you develop your plan – this will help you ensure that you start off on the right foot. How much debt do you have? How much do you have in savings and your super or KiwiSaver? How much can you afford to invest? Using a budget planner is a great starting point.

Understanding investment options

Before diving in and investing blindly, it’s essential to understand the various investment options available and whether your goal is to invest for a short, medium or longer period of time. In both Australia and New Zealand, government agencies play a role in educating people about what investment options are available.

In Australia, the MoneySmart government website provides a plethora of information on investing and what to do, know and understand before you develop your own investment plan. In New Zealand, the Reserve Bank of New Zealand offers some easy to understand information that can help guide you. Both organisations offer relevant regional options and offer comprehensive resources on things like stocks, bonds, managed funds and property, just to name a few.

All investments are subject to risk and there are many different types of risk. You need to know what they are and consider how comfortable you are with them before choosing an investment strategy.

Asset classes

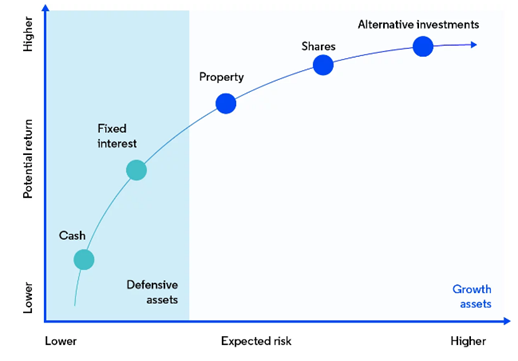

These refer to the different investment categories with similar features and how they are grouped. Understanding asset classes is important, so that you know what to expect when it comes to your investment timeline and returns. The main asset classes include:

- Cash

- Bonds and fixed interest

- Property

- Shares

- Alternative assets

Cash and fixed interest (bonds) are generally known as defensive assets. This means they are designed to guard you against losses on your investment and they are generally suited for investors who prefer secure and safe investments with some consistency in the returns they provide.

At the other end of the risk spectrum, property and shares are known as growth assets. These investments are best suited to investors seeking potentially higher long-term growth, knowing that the value of their investment will fluctuate and there will be a higher chance of negative returns over shorter time periods.

Below is a diagram that visually explains the risk versus return possibilities of different asset classes. Read more here in Australia and New Zealand in relation to asset classes.

Managing risk

Diversifying your investment portfolio can be a fundamental strategy to mitigate risks and optimise your returns. Spreading your investment across various asset classes may help cushion the impact of market fluctuations and ensures that your financial wellbeing isn’t solely dependent on the performance of a single investment.

Starting your investment portfolio

Many people are under the misconception that you need significant capital, but small, consistent investments can accumulate over time. Where you invest your money will depend on your personal financial goals, what your risk appetite is and how long you have to invest your money.

When developing an investment plan, it’s crucial to align your choices with your personal goals. Whether you’re saving for a house, your future financial freedom or even your children’s education, your objectives will guide your investment decisions. Stay informed on the investment landscape. And if you’re unsure, seek advice from a qualified financial adviser who can provide personalised insights based on your unique financial situation and goals.

Conclusion

In a climate of high inflation and rising living costs, developing a robust investment plan, even with small amounts can play an important part in securing your financial future. By understanding your investment goals, your appetite for risk and diversifying your portfolio, you can be on your way to making informed investment decisions.

What you need to know

Resolution Life Australasia Limited ABN 84 079 300 379, NZ Company No. 281363, AFSL No. 233671 (Resolution Life) is the issuer of this article. Any advice in this article is provided by Resolution Life and is general advice and does not take into account your objectives, financial situation or needs. Therefore, before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the relevant product disclosure statement and/or policy document, available from Resolution Life in Australia at resolutionlife.com.au or by calling 133 731, or in New Zealand at resolutionlife.co.nz or by calling 0800 808 267, before making a decision about the product. Resolution Life is part of the Resolution Life Group and can be contacted via Contact us - Resolution Life (Australia) or Contact us - Resolution Life (New Zealand).